SFM's Comments About Recent Activity in the Investment Markets

The US stock market is now on pace to have fallen in each of the last 7 weeks. Before this sell-off, we had not had a decline in 5 consecutive weeks since June 2011. Investors' biggest concern has been inflation, which has continued to stay stubbornly high in the US, though it may have peaked in March at 8.5% year-over-year as the April inflation number showed a decrease of -0.2%. This and other data show that inflation is gradually decreasing, but it will take some time.

Also, interest rates are normalizing and raising the cost of capital for businesses and lowering future profit margins. This has prompted investors to revalue how much they’re willing to pay for a stock and the market has fallen accordingly. The US Stock Market (represented by the S&P 500 Index) is now trading at 16.6 times the expected annual profit of all of the 500 companies together. As painful as the market decline has been, we have simply reverted to the mean in terms of value as we are now slightly lower than the 25-year average of 16.85. Company profits have still been good despite lower future growth outlooks, and the job market has remained strong which points to better days ahead.

Our thoughts are that the stock market is likely to remain very rocky over the next few months and will likely go lower from here before stock prices eventually rebound. If we get some good news on inflation, interest rates, the war in Ukraine, etc. then we think the stock market will react strongly to the upside.

As we have discussed in the past, it is impossible to time the market (getting in and out of stocks at the right time). Often the rebounds happen quickly and a lot of them in just a few days. Trying to figure out which days those are before they happen is impossible. However, we do follow a lot of market indicators, and one of them is the consumer confidence surveys, which have shown to be successful as contrary indicators. Historically when everyone is optimistic and consumer confidence is high, it is usually not the best time to purchase stocks. In the 12 months following consumer confidence hitting a high, the US stock market has returned only +4.1%/year on average. On the other hand, in the 12 months following consumer confidence hitting a low (as it is now), it is usually a good time to buy and has averaged +24.9%/year.

Our investment philosophy is to identify best-of-breed companies with superior and lasting competitive advantages, high returns on invested capital, and robust growth opportunities that can create value for shareholders. Then we attempt to purchase these companies at a discount to our estimate of their value with a plan to hold these stocks long-term through various economic cycles (booms and busts). So far, 2022 is an example of the most difficult part of any long-term investment strategy, which is holding through the downturns. However, it is important to remember that this investment strategy works best when you stick with it through the ups and the downs. Selling and missing out on just a few days of a market rebound can drastically reduce your long-term returns.

It is important to keep in mind that stock market declines like the one we’re experiencing are normal, though they are painful to go through. Unfortunately, no one knows how severe the downturn will be, how long it will last, or how long it will take to recover. However, all market downturns share one unifying factor to keep in mind: historically the stock market has always recovered. The key is to continue to think and invest long-term and stick to your financial plan. Even in retirement, your assets need to last the remainder of your life, which for someone aged 65, could be another 20-30 years.

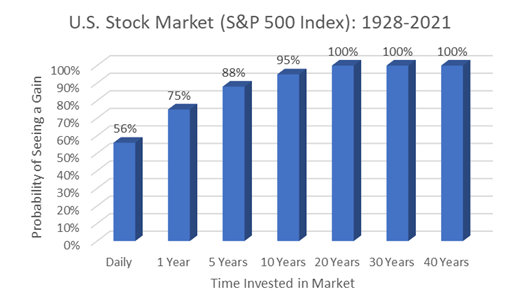

Market commentator Ben Carlson wrote: “Many people compare the stock market to a casino but in a casino, the odds are stacked against you. The longer you play in a casino, the greater the odds you’ll walk away a loser because the house wins based on pure probability. It’s just the opposite in the stock market.” This is shown by the chart below, which shows a 0% historical chance of losing money when invested in the S&P 500 over 20+ years, no matter when you timed things.

There is always a risk that the stock market declines tomorrow, as technically the market will decline 4 out of every 10 days on average. And this decline could continue for another 6 months or even longer. Still, as the chart above shows, the risk of losing money in the US stock market over 5 years has historically been only a 12% chance. This risk drops to a 5% chance in any 10 years, and 0% as long as you’re invested for 20 years or longer. The US stock market has produced a positive return of over +850% during even the worst 30-year period in history. So even if your timing is the worst and you invest right at the top, as long as you stayed invested you would have earned a profit of more than 8 times your initial investment over 30 years. Investing confidently and based on a plan isn’t always easy, but it does pay off in the long run

Despite the market downturn, there is a bright side during these times. For example, further contributions to your 401k/403bs, or other employer retirement accounts on a weekly/bi-weekly basis will be averaging in at lower and lower costs during this time. This gives you increasingly more shares of high-quality investments. When the markets recover, you’ll have more value than you would have had otherwise. The same can be said for regular contributions to your accounts with SFM. The market has rolled its value back to late 2020/early 2021 and you can think of this as an opportunity to go back in time and invest at prices from 18 months ago (despite corporate profits being higher now). When things recover, you’ll have benefited by purchasing at lower average costs.

Another benefit to a downturn, which we’ve been taking advantage of over the last week in taxable accounts (not in IRA Accounts), is tax-loss harvesting. This means we can sell one investment at a loss and purchase a similar investment, which we also like, and at the same time to replace it. You are still invested, but now when the market recovers, you also have a tax loss stored to offset any future capital gains. This strategy allows us to help reduce the federal tax you pay and improve your after-tax investment returns, which is one of our top priorities for you.

We know that declines in the value of your investment portfolio can be painful and stressful to live through. We also know that this is a normal part of investing. Regardless, we will continue to help advise you, during good times and the bad, while always keeping a focus on your long-term plan and helping you understand how to best get there. Staying invested during these periods is critical to meeting your financial goals. We will continue to monitor important developments in the market and make appropriate adjustments to your portfolios as necessary. Thank you for your continued trust in SFM to guide you through volatile times like this.

Please don’t hesitate to give us a call or email with any thoughts or concerns that you have (or if you are just plain nervous).

The SFM Team - Chris, Glenn, Sam, David, and Molly